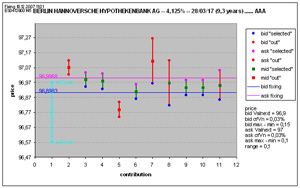

- Cotation Fixing

Click to enlarge

Starting with cotations taken at the same moment, the system calculates the Fair value of the Bond, filtering out the contributions beyond the consensus. The dark blue line represents the Fair value (96.90), calculated by Valnext (the “Valnext bid”). The contributions in red have been filtered, because, according to our algorithm, they are too far from the consensus.The special filtering methods have been created by Valnext in order to refind the market consensus of the two price series bid and ask, in a simultaneous manner.

- If we are searching for the most representative bid price (the fair value), independently from the ask price, it is possible, in certain cases, that the estimated bid price is superior to the estimated ask price, this being a nonsense. We therefore have to treat the problem as a whole, taking into account the information on every couple (bid, ask), inextricably. This represents an additional difficulty from the point of view of searching for an adapted filter.

BONDVALUE users have all necessary audit trails, including relevant statistics for verifying that the estimated price is coherent with available market information at the same moment.

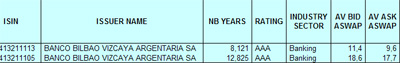

An Excel example of a portfolio is shown below :

The « bid aswap » and « ask aswap » columns are asset swap average spreads (bid and ask) , calculated in basis points from filtered contributions, including swaps interest rates at the cotation moment.

The “σ bid price Valnext” variable corresponds to the standard deviation of bid price after filtering. A bond where the standard deviation is weak, and has a large number of contributions is a good indicator of the estimated price being reliable. In these examples, the standard deviations are weak (<0.04), which allows us to obtain good estimations for the bonds that have at least 3 contributions after filtering.

- A « Proxy method » example :

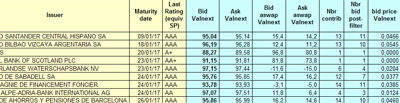

The estimation method by proxy consists of taking the estimated asset swap spread of a bond and valuing the average spread of bonds, the closest in terms of rating, maturity, issuer, activity sector.

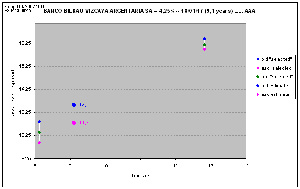

In the example below, the spread has been estimated by interpolating between the spreads of the two closest bonds from the same issuer.

The asset swap spreads estimated for the bid and ask price are therefore at 11.3 bp and 12.9 bp.

The equivalent prices are reconstituted in the graph below. The Bond Fair value calculated by the proxy method is at 96.14, given that the bid price was estimated.

The relative informations of the two bonds used in the estimation are shown in the table below :